This post is part of a series documenting entrepreneurship in Mexico and the companies who participated in the inaugural Unreasonable Mexico program.

For 85 percent of Mexicans, one out of $13 of their savings makes it into a bank account. The other $12 are saved informally—kept in cash under the mattress, for example.

“People say that because of the culture in Mexico that people don’t save, and I disagree,” says Enrique Bay, CEO of KIWI, a company that provides tailored pre-payment plans based in Mexico City. “They save much more than they take out loans—it’s just done differently than other parts of the world.” Traditional banks don’t offer affordable avenues for customers to borrow money for important costs like healthcare. High interest rates prevent the majority of the population from turning to extant financial systems for help.

KIWI just celebrated their 10th completed payment plan: Ten individuals fully paid off an agreed amount of funds in a timely manner in order to access health care they wouldn’t otherwise be able to afford—and they’re on their way to twenty. KIWI takes a small commission from the provider once the plan is completed. The goal is to expand to other verticals: education, insurance, business materials, and savings accounts. The ambition for the coming year is to see at least 1,000 payment plans created and paid off, thus stimulating the economy and sometimes, saving lives.

“A woman with no friends or family needed a surgery and wasn’t able to afford it,” recalls Bay. “We offered a flexible payment solution and in three months she had paid it off. Later we learned she had contemplated suicide and knowing that we were able to be a part of helping prevent that meant a lot.”

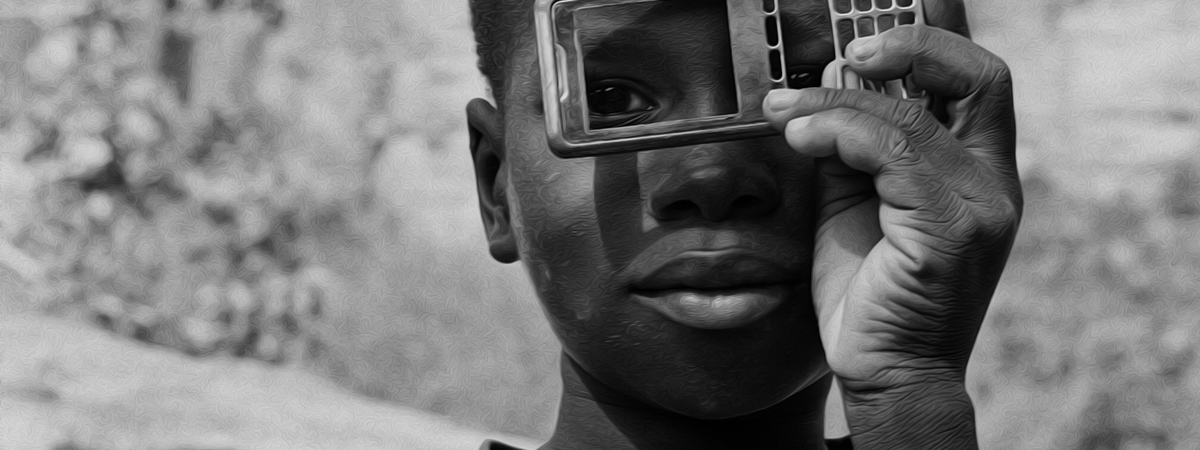

Part of keeping up with the growth means adding more committed staff to communicate directly with the user. This solidifies the human connection—there are faces behind the payment plans.

Bay dreamt up KIWI while at MIT for his MBA. Like most ventures without a handed down blueprint to work from, there were lots of sleepless nights. “One thing that worked for me,” recalls Bay, “is believing that if you persevere that something will work.”

He wanted a solution to provide the population of Mexico with the ability to afford goods and services without the cumbersome nature of bank loans, gimmicks and high interest rates. “We recognize that financial institutions are hard to trust,” explains Bay. “We don’t think of ourselves as a financial service company, rather as a solutions company—it’s a specific solution. The way we establish trust is we partner with a service provider and they offer our service to their patient.”

The BOP wants to save, wants to trust, wants to grow. They only need means to reach their goal Tweet This Quote

KIWI’s partnerships in the healthcare sector allow patients to obtain life changing surgeries, medicine and treatments they otherwise could not afford. A merchant, clinic or retailer can sign up for KIWI and offer their customers the option to pre-pay for a service through an established technology platform that personalizes affordable payment plans. A user can pay the agreed upon installments in any of the 12,000 convenience stores through Kiwi’s collection partner—the merchant benefits by widening their customer base and increases their sales. “We don’t charge a fee or commission to the user,” says Bay. “They only pay the cost of the service. We transfer the funds and charge the commission to the sector or provider.” Kiwi asks for a commission of ten percent based on the completion of the plan.

Investors often want to know about similar models to KIWI—does anything like it exist? According to Bay, the answer is no: “Banks are falling behind in products and services. They can’t experiment. We can be the front facing service and they can provide back end services that would help in our scaling. We are a new company. It’s hard to decide a perfect marketing strategy without points of reference that already exist. Eventually, we want to incorporate new services like insurance and savings accounts by partnering with banks and other financial institutes.” This approach ensures KIWI can adapt to long term economics.

“The BOP wants to save, wants to trust, wants to grow. They only need means to reach their goal, and KIWI will be one of those tools.”