Solving global challenges is a moral imperative and an unprecedented financial opportunity.

The 394 ventures in the Unreasonable Fellowship provide investors in our community with a highly curated portfolio of private investment opportunities. Through a managed syndicate, a dedicated fund, and sharing deal flow aligned with your investment preferences, we connect capital to ventures operating at the nexus of impact, advanced technology, and profit.

Invest into ventures building a better future.

394

Ventures

Added 34 in the last year

$16 bn

Total Financing Raised By Unreasonable Ventures

$16 bn

Total Revenue Generated By Unreasonable Ventures

1.4 bn

Lives Positively Impacted

Unreasonable Investors participate in rounds led by top-tier investors

* These funds have all led financing rounds into Unreasonable Ventures

Invest into select deals with us

This is community driven investing

Our syndicate, formerly “The Unreasonable Collective,” is designed for accredited investors looking to participate in curated opportunities across the Unreasonable Fellowship.

Each year, we syndicate 4 to 6 opportunities for the funders in our community. There are no annual or upfront fees required to gain access to our syndicate. If you choose to invest, we charge a standard 2% management fee and 20% carried interest on a deal-by-deal basis. Read more about pricing or express interest in joining our community. To date, we have syndicated investments into the 21 ventures highlighted below.

AirEx Technologies

Bridging the analog and digital divide for smart ventilation control

View Profile »

Agnes Czako

Founder & CEO

Air Protein

Using microbes to convert elements of air into a sustainable protein product

View Profile »

Lisa Dyson, PhD

CEO at Air Protein

At One Ventures

View Profile »

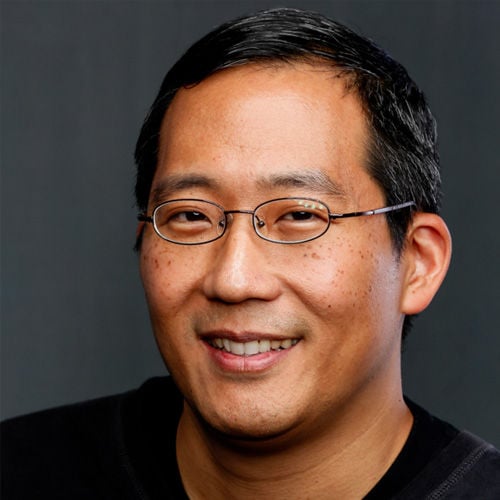

Tom Chi

Founder

BlocPower

We reduce fossil fuel consumption, waste, and pollution by decarbonizing buildings.

View Profile »

Hanan Levin

Co-CEO

Cabinet Health

Eliminating plastic waste in healthcare.

View Profile »

Achal Patel

Co-Founder & CEO

Classcraft

Developing a free, online educational role-playing game in 11 languages for millions of students and teachers in classrooms around the world.

View Profile »

Craif

Realising a society where people can live out their natural lives.

View Profile »

Ryuichi Onose

Cofounder & CEO

Dendra Systems

Using drones to plant 1 billion trees per year to tackle industrial-scale deforestation.

View Profile »

Susan Graham

CEO and co-founder

Dispatch Goods

Making reusable packaging accessible to restaurants, caterers, and meal delivery businesses.

View Profile »

Lindsey Hoell

Co-Founder & CEO

EpiBone

Creating bone tissue from a patient's mesenchymal stem cells in vitro for use in bone grafts.

View Profile »

Nina Tandon

CEO & Co-Founder

Evrnu

Recycling cotton garment waste to create premium, renewable fiber for the creation of new clothing.

View Profile »

Stacy Flynn

Co-Founder and CEO

GALY

Agriculture made from cells in a facility, not plants on a field.

View Profile »

Luciano Bueno

Founder & CEO

Goodr Co.

Providing an end-to-end profitable solution for businesses to reduce food waste and combat hunger

View Profile »

Jasmine Crowe

Founder & CEO

Greyparrot

Automating waste composition analysis using AI-powered computer vision software

View Profile »

Mikela Druckman

Co-founder and CEO

Plant Prefab

Building a better world, by design.

View Profile »

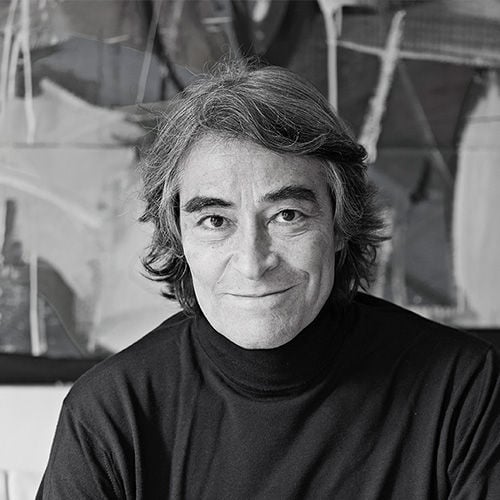

Steve Glenn

Founder, CEO, Chair of Board

SmarterX

SmarterX is an AI-powered data platform that helps retailers and brands make compliant and sustainable decisions about consumer chemical products (e.g., cleaners, cosmetics, batteries, electronics).

View Profile »

Charlie Vallely

Co-founder and CEO

Someone Somewhere

Using Artificial Intelligence and a fully traceable supply chain to support indigenous artisans in making sustainable textile products that honor their heritage and uplift them out of poverty

View Profile »

Antonio Nuño

Co-Founder & CEO

The Jackfruit Company

Making jackfruit mainstream by providing consumers with this delicious, healthy, sustainably-sourced meat alternative that also improves farmer incomes.

View Profile »

Annie Ryu

CEO & Founder

TurtleTree

Recreating the full composition, functionality and taste of milk using the latest cutting edge innovation in biotech

View Profile »

Fengru Lin

Founder & CEO

Unspun

Building the world's first 3D weaving technology for fashion.

View Profile »

Walden Lam

Co-founder & CEO

Wild Earth

Reinventing pet food with science to make complete, clean protein pet foods that are healthier for pets and better for the environment

View Profile »

Ryan Bethencourt

Co-Founder & CEO

Democratizing Access to Finance

While deal flow is our differentiator, our global community is our greatest asset. With the goal of making venture investing more inclusive, accredited investors in the Unreasonable community can allocate as little as $10,000 USD into any deal that we structure. To date, more than 162 individuals have participated in our syndicate. Below are just a few of the individual investors in our community you can invest alongside.

Chid Liberty

Co-founded Africa's first Fair Trade Certified™ apparel manufacturer

Christiana Musk

Serial Entrepreneur & Operating Partner at Satori Capital

Sir Stephen O'Brien

International Businessman; Global Leader: Humanitarian/Emergency Relief/UN+Multilateral/Global Health; Government; Diplomat; Politician; Lawyer

Betty Hudson

President, Hudson & Associates; Former Chief Communications Officer at National Geographic

Chris Yeh

Investor, Writer, Mentor, Serial Entrepreneur and Partner of Blitzscaling Ventures

Mohanjit Jolly

Venture investor specializing in mid-stage technology companies in India

Kate James

Board member for Vital Voices & National Audubon Society

Jeremy Jauncey

Founder & Chief Executive Officer at Beautiful Destinations

A unique rules-based global fund strategy

Targeting material societal, ecological & financial returns

For institutional investors, family offices, and donor-advised funds not interested in a discretionary deal-by-deal investment approach, we are gearing up to raise a new investment fund.

Utilizing a rules-based strategy that centers on the 394 ventures in the Unreasonable Fellowship, the Fund will invest alongside qualified lead investors into attractive, rapidly expanding private companies positioned to address global challenges and generate outsized returns.

We anticipate actively fundraising in 2026. Let us know if you are interested and our team will reach out when we begin fundraising.

Join the waitlist »The Fellowship has 400+ CEOs, headquartered in 47 countries.

40+ of the CEOs in the Unreasonable Fellowship are women.

Unreasonable Ventures have raised more than $16 bn in financing.

Unreasonable provides to Fellows, on average, 35 warm intros to the 2,700 investors in our network.

On average, Fellows have generated more than $40 m in revenue.

On average, Fellows have each raised more than $39 m in funding.

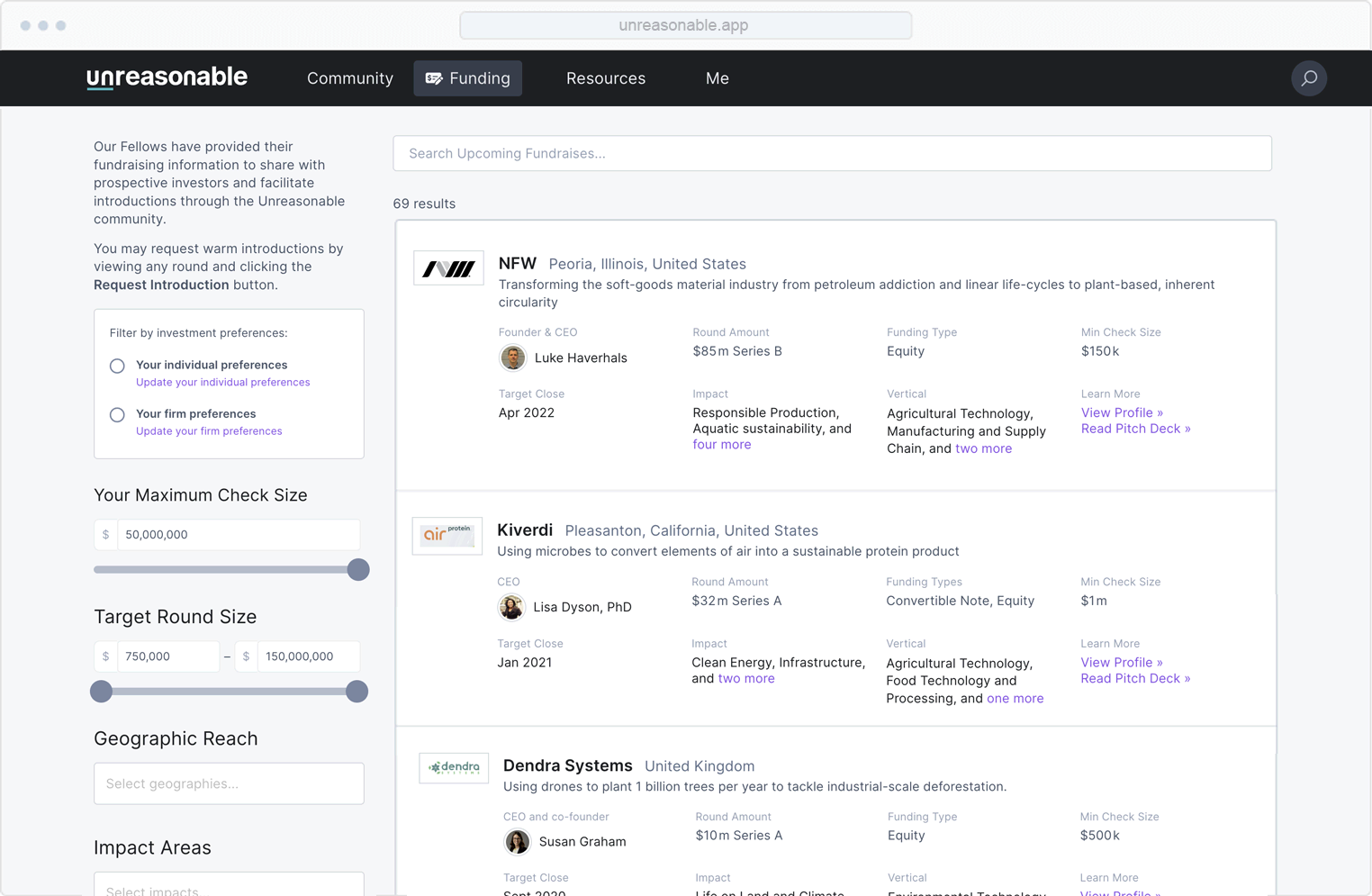

Personalized Deal Flow

Receive a monthly email with investment opportunities across the Unreasonable Fellowship that are aligned with your funder preferences. Today, Unreasonable has direct relationships with more than 1,255 sources of capital ranging from venture funds to banks, private equity firms, sovereign wealth funds, foundations, unilateral agencies, and family offices.

By becoming an “Unreasonable Capital Partner,” we will send you opportunities as they arise across our global portfolio that uniquely match your investment interests. We charge nothing for this service. Our goal is simply to accelerate the flow of capital into ventures dedicated to building a more regenerative and equitable future.

Register to become a Capital Partner »

Join the Unreasonable Investment Community

Frequently Asked Questions

How do I become an Unreasonable Investor?

To become an Unreasonable Investor, you must meet the standards of an accredited investor as defined by the U.S. Securities and Exchange Commission as well as the accreditation requirements stipulated in your region. Prior to joining our community as an investor or institutional investment firm, you will be required to complete certain representations and warranties relating to your accredited investor status. If you are interested, you can express your interest in joining our community.

Can I invest in an Unreasonable syndicate if I am not a U.S. Resident?

What are the costs associated with investing with the Unreasonable syndicate?

Instead of charging ongoing fund-expenses, we do charge a one-time structuring fee that is exclusively used to cover the costs of hosting our special purpose vehicles ("SPVs") on carta.com. This fee is charged when you place your investment to cover the administration, legal, tax filing and structuring costs for all opportunities we present via our Syndicate. This one-time fee will vary based on the investment dollars that we raise in an SPV and will typically range between 1-2.5% of your committed investment amount.

What is the minimum amount I can invest into an Unreasonable syndicate?

What are the costs associated with investing into an Unreasonable dedicated fund?

What are the costs associated with personalized deal flow? Is it really free?

Do you really believe investing into impactful companies is not concessionary?

Beyond investing, what does it mean to be a part of the Unreasonable community?

What is Unreasonable's sector, technology, and geographic focus?

To ensure our members see the best deals worldwide and to offer a level of diversification not easily found anywhere else, each year, we will syndicate investment opportunities across geographies, sectors, and technology stacks. All companies that Unreasonable supports will, in addition to financial metrics, track their progress by measuring one or more of the 17 Sustainable Development Goals as set by the United Nations (including among them but not limited to: clean energy access, sustainable agriculture, universal education, universal healthcare, and global financial inclusion). Read more about our thematic portfolio of solutions.

What is Unreasonable's primary business model?

What exactly is the Unreasonable Group?

We are a Colorado-based, international certified B-corporation that supports a Fellowship for growth-stage entrepreneurs, channels exclusive deal-flow to investors, and partners with institutions to discover profit in solving global problems. The 394 ventures in the Unreasonable Fellowship operate across more than 180 countries, have collectively generated $16 bn in revenue, raised $16 bn in financing, are positively impacting the lives of more than 1.4 bn people, and have reduced more than 143 m metric tons of greenhouse gas emissions from our atmosphere. Read more about our work more broadly.